Ce n'est pas une tâche facile que d'essayer de guider les entreprises en phase de démarrage dans l'élaboration de leur premier plan de rémunération des ventes. Ouf... préparez les fourches pour tous les commentaires à venir !

Mais cela vaut la peine d'essayer. Dans le cadre de mes fonctions chez Battery, je travaille avec de nombreuses entreprises qui en sont encore à la phase d'élaboration de leur stratégie GTM, et dont les plans d'entreprise sont souvent moins aboutis. Je me sers de ce blog pour aborder certains des principes fondamentaux de la planification de l'emploi que je passe souvent en revue lors de ces conversations.

Les bases de la planification computationnelle

Il existe trois de ce que j'appelle les "conventions fondamentales" d'un plan de rémunération. Tout d'abord, faites simple - un représentant vend X, qui est multiplié par le taux Y, ce qui signifie qu'il gagne Z. Ensuite, faites logique - le montant de la vente multiplié par le taux devrait donner le montant de la commission variable d'un vendeur. Enfin, et surtout, il doit être motivant.

Commençons par le point de vue du représentant commercial. Lorsque je faisais passer des entretiens à des AE de haut niveau, j'entendais souvent quelques vieilles rengaines au cours du cycle d'entretien :

- Combien le premier AE a-t-il gagné l'année dernière ?

- Combien de vos représentants ont atteint leur quota ?

- Quel sera mon territoire ?

- Puis-je voir une copie du plan d'action ?

Il peut être difficile de répondre à certaines de ces questions pour les entreprises en phase de démarrage, mais ce sont toutes des questions auxquelles vous devriez aspirer à répondre avec fierté. Et si vous souhaitez recruter des talents de premier plan, vous devez anticiper ces questions.

La dernière de ces questions - puis-je voir le plan d'entreprise - est le moment de vérité. Si vous avez peur de partager votre plan de rémunération, c'est que quelque chose ne va pas. Le plan de rémunération est un excellent outil de recrutement et, s'il est bien conçu, c'est une arme secrète pour attirer les représentants les plus performants.

Les éléments essentiels d'un plan d'action

Tout plan de rémunération comporte trois éléments clés : le quota, le moment du quota et le montant de la commission variable. Ces trois éléments forment ensemble le plan d'entreprise. Commençons donc par eux et passons ensuite à quelques exemples.

Quota

Le quota est généralement un montant en dollars de ventes qu'un représentant doit conclure. Dans les organisations à forte vélocité, elle pourrait être basée sur le nombre de logos signés. Dans les modèles de consommation, il peut y avoir un certain nombre de variables. Mais pour des raisons de simplicité, les quotas basés sur le dollar sont les plus courants, alors partons de là et disons que notre quota est de 1 000 000 $.

Calendrier

Nous avons dit plus haut que le montant du quota est d'un million de dollars. Ensuite, il faut déterminer la période de temps allouée pour atteindre le quota. Les options les plus courantes pour les calendriers de quotas sont les quotas mensuels, trimestriels et annuels. Cet élément temporel est essentiel, car il crée un état d'esprit sur la façon dont les représentants des ventes s'y prennent pour conclure des affaires.

Par exemple, si un AE a un quota trimestriel qui comprend des taux accélérés pour >100% de performance (plus d'informations sur les accélérateurs ci-dessous), et qu'il est au-dessus de son quota, il se rend compte qu'en concluant plus d'affaires alors qu'il est au-dessus de son quota = plus de revenus pour moi. C'est le facteur de motivation des plans de rémunération.

Et les commerciaux avisés savent que plus les cycles de quotas sont nombreux avec un accélérateur, plus ils ont de chances d'obtenir une commission plus importante.

Variable

Les représentants commerciaux sont des personnes uniques. Ils acceptent un emploi dont une partie du salaire est fixe - le salaire de base - et une autre partie du salaire est variable - le montant de la commission. Tout le monde n'est pas apte à bénéficier de ce type de plan : Si je vends beaucoup, je gagne beaucoup. Mais si je ne vends pas, je ne touche pas de commission (et je peux même perdre mon emploi).

Sur le site SaaS, il est très courant de voir des représentants commerciaux bénéficier de ce que nous appelons un plan 50/50, c'est-à-dire qu'ils perçoivent 50 % de leurs revenus cibles sur leur salaire de base et les 50 % restants sur un montant variable commissionnable. Ensemble, le salaire de base et les commissions sont appelés OTE : on-target earnings.

Vous vous demandez peut-être pourquoi quelqu'un se soumettrait à ce type de torture financière et mentale ? Parce que l'OTE repose sur le fait que les commerciaux atteignent 100 % de leur quota. Un bon plan de rémunération incite un représentant à dépasser les 100 %.... parce qu'elle est plus rémunératrice. C'est la raison d'être d'un accélérateur. L'accélérateur est un taux de commission plus élevé payé aux commerciaux qui dépassent leur quota. Les entreprises qui n'intègrent pas d'accélérateur ou qui n'intègrent pas suffisamment d'accélérateur dans leur plan créent des obstacles à l'embauche de bons talents.

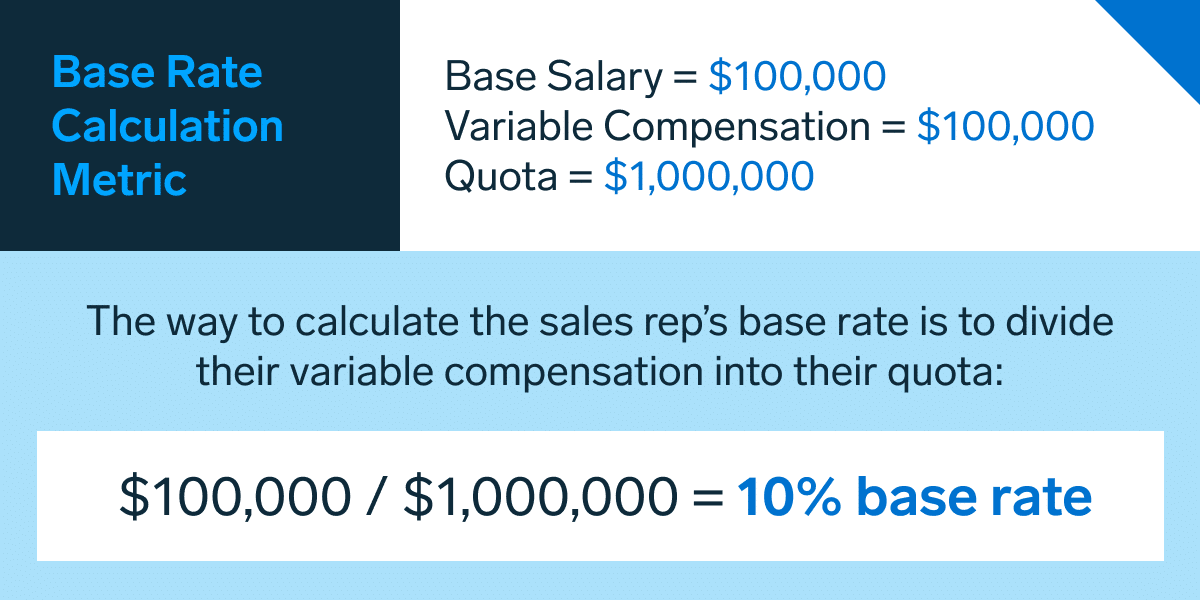

Avant de vous donner des exemples, abordons la formule la plus élémentaire de planification des rémunérations : le calcul du taux de base et du taux accéléré. Je vois souvent des plans de rémunération dont les calculs mathématiques ne sont pas clairs. C'est pourquoi je vous propose cette mesure simple qui permet de calculer le taux de base.

Cela signifie que si un représentant vend pour 1 million de dollars de logiciels et est rémunéré à hauteur de 10 %, il gagne 100 000 dollars. C'est assez facile, non ?

Vous seriez étonné du nombre d'entreprises qui n'utilisent pas cette simple formule de taux de base. Au lieu de cela, ils lisent un blog, trouvent quelques idées et décident ensuite de "forcer" leurs taux de commission. J'entends des commentaires étranges comme "Je ne veux pas que mes représentants gagnent plus de 9 %" ou "Je veux plafonner le montant que mes représentants peuvent gagner".

C'est une mauvaise idée. Si le représentant vend Logiciel, votre entreprise gagne de l'argent. Si le représentant vend plus qu'il n'est censé le faire, il doit partager les bénéfices.

Taux accélérés :

Nous avons maintenant établi la formule pour déterminer le taux de base que vos représentants commerciaux recevront. Il s'agit à présent de déterminer la partie la plus motivante, à savoir les accélérateurs.

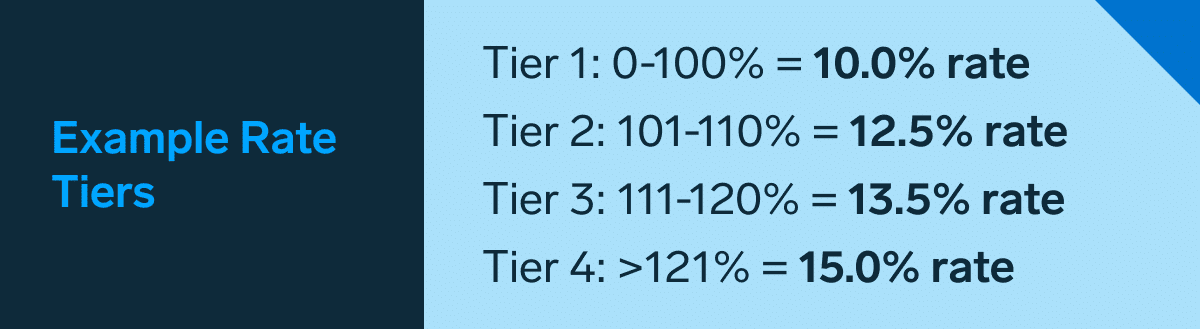

Malheureusement, il n'existe pas de méthode commune pour déterminer le taux d'accélération, mais une règle empirique couramment utilisée est de 125 %. En d'autres termes, si votre taux de base est de 10 % et que vous dépassez votre quota, le taux augmente de 125 % pour atteindre 12,5 %. Mais attendez, ce n'est pas tout ! Certains plans de rémunération prévoient des "paliers" pour les taux supérieurs à 100 % du quota. Par exemple, vous verrez des plans qui paient 125 % pour 101-110 % de performance, puis 135 % pour 111-120 % de performance, et enfin 150 % pour 121 % et plus de performance. Il s'agit d'un facteur de motivation - les représentants recherchent les taux les plus élevés, ce qui est bénéfique pour tout le monde. Le représentant qui réalise plus de ventes gagne des commissions plus importantes, et l'entreprise obtient plus de revenus MAINTENANT.

Bien qu'il n'existe pas de formule spécifique pour déterminer l'accélérateur, les commerciaux expérimentés savent reconnaître un bon accélérateur d'un mauvais. Encore une fois, si vous voulez recruter les meilleurs talents, sachez que les meilleurs vendeurs vont là où ils peuvent gagner beaucoup d'argent.

EXEMPLES DE PLAN :

Voyons comment fonctionnent les plans d'indemnisation. C'est amusant, car vous verrez comment le calendrier et les niveaux jouent un rôle dans le potentiel de revenus d'un représentant commercial.

Pour tous les exemples, supposons que les niveaux de tarification sont les suivants :

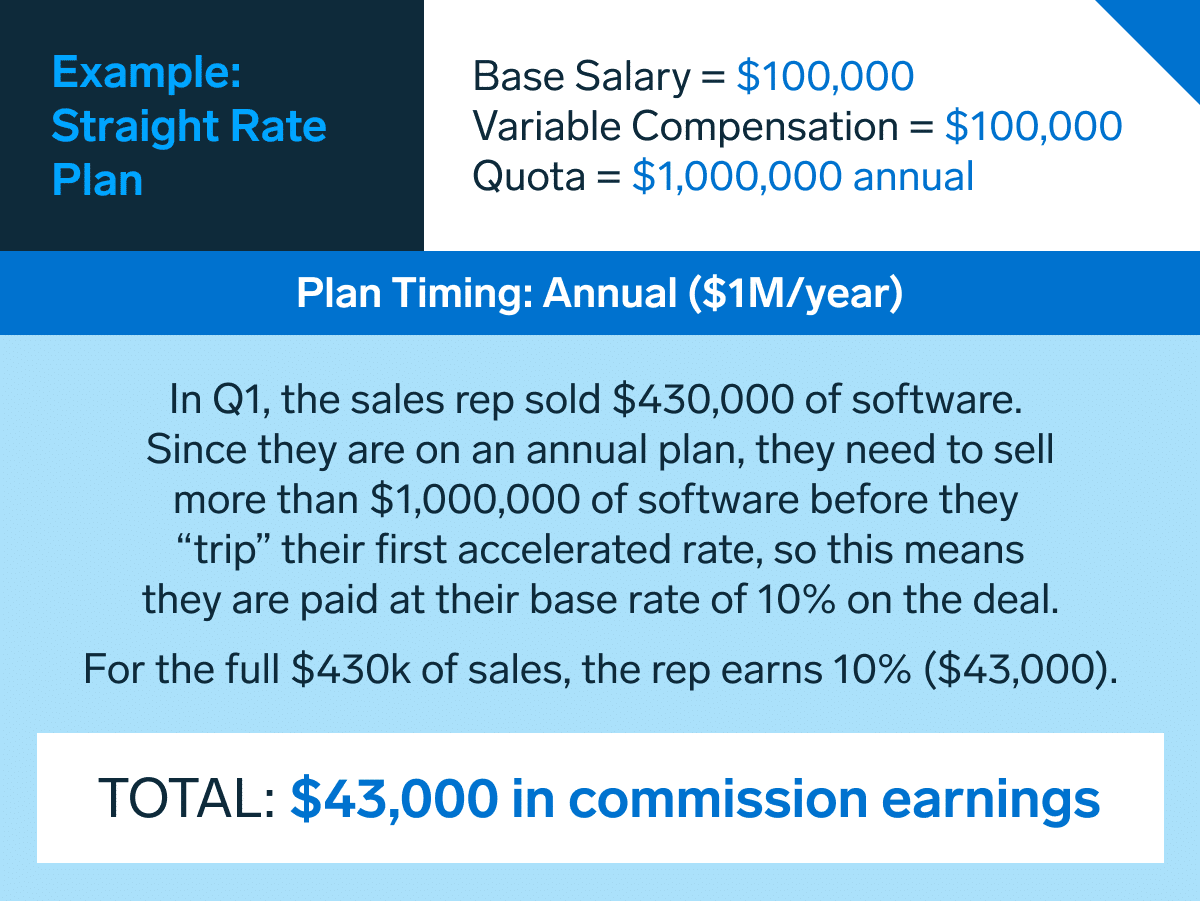

Exemple 1 : Plan à taux fixe

Il s'agit de la version la plus simple d'un plan de rémunération et, à vrai dire, elle n'est pas très excitante pour un représentant commercial. Mais il donne le ton, alors commençons par lui.

C'est assez simple : j'ai vendu 43 % de mon quota et j'ai gagné 43 % de ma rémunération variable. Comme indiqué plus haut, il n'est pas trop complexe, mais il ne me motive pas à travailler dur pour atteindre un délai mensuel ou trimestriel dans la conclusion de mes affaires.

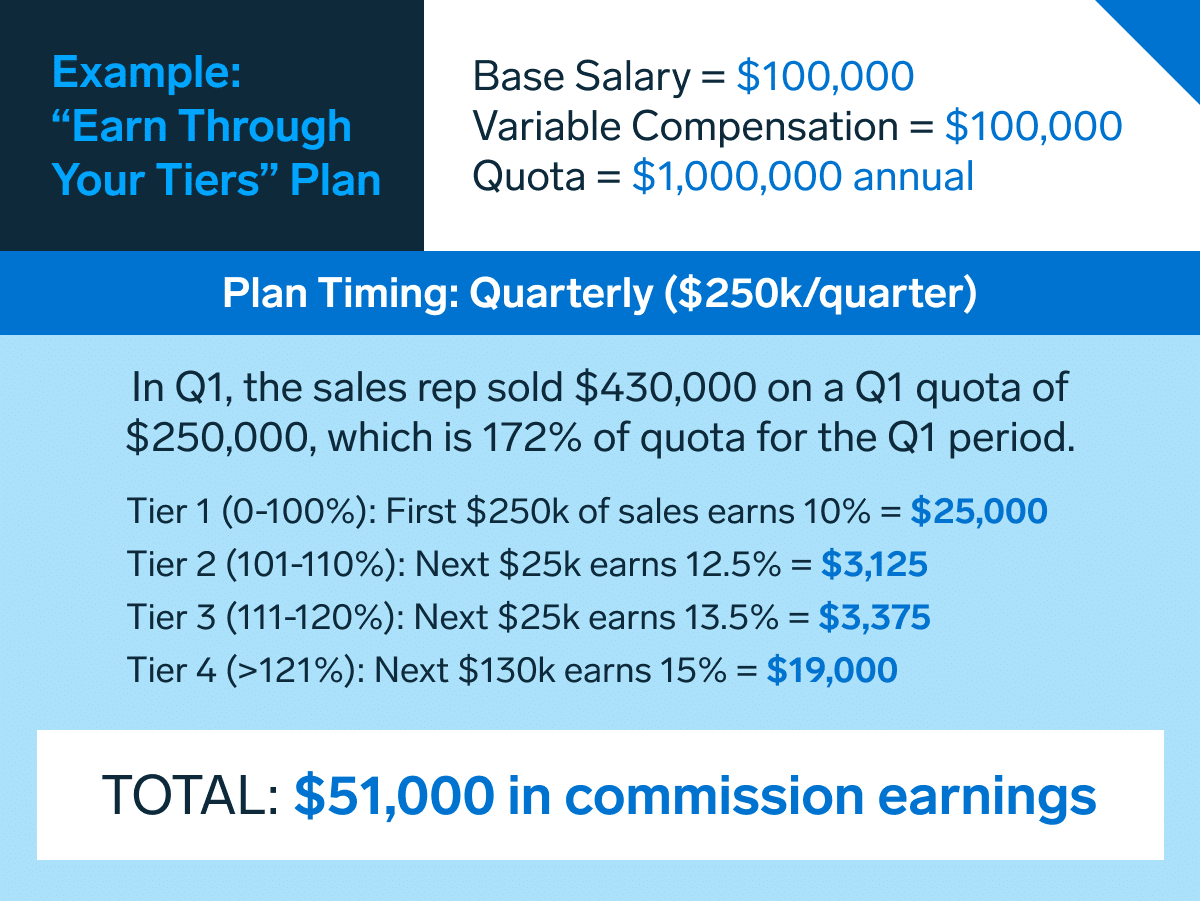

Exemple 2 : Plan "Earn Through Your Tiers" (Gagnez de l'argent grâce à vos paliers)

C'est là que la planification de la rémunération devient intéressante, car ce type de plan offre un peu plus de "jus" au représentant commercial. Dans ce cas, le représentant a un quota annuel de 1 million de dollars, mais il s'agit d'un calendrier trimestriel, ce qui signifie que le représentant a un quota trimestriel de 250 000 dollars. Cela signifie également que si le représentant vend plus de 250 000 dollars au cours du trimestre, il passe au taux accéléré.

Vous voyez ce qui s'est passé entre l'exemple 1 et l'exemple 2 ? Le représentant a conclu la même affaire de 430 000 dollars, mais il a gagné 43 000 dollars dans un cas et 51 000 dollars dans l'autre.

Dans le premier scénario, le représentant a atteint 43 % de son quota annuel et a gagné exactement 43 % de sa variable. Dans le scénario 2, ils ont atteint 43 % de leur quota annuel, mais comme il s'agissait d'un plan trimestriel, ils ont perçu 51 % de leurs commissions annuelles. En d'autres termes, le représentant était censé gagner 25 000 dollars à 100 % de son quota dans l'exemple 2. Ils ont vendu 172 % de leur quota pour le premier trimestre et ont gagné 204 % de la variable ciblée (ils ont gagné 51 000 dollars par rapport à un objectif de 25 000 dollars).

Ce plan s'est bien accéléré et est motivant.

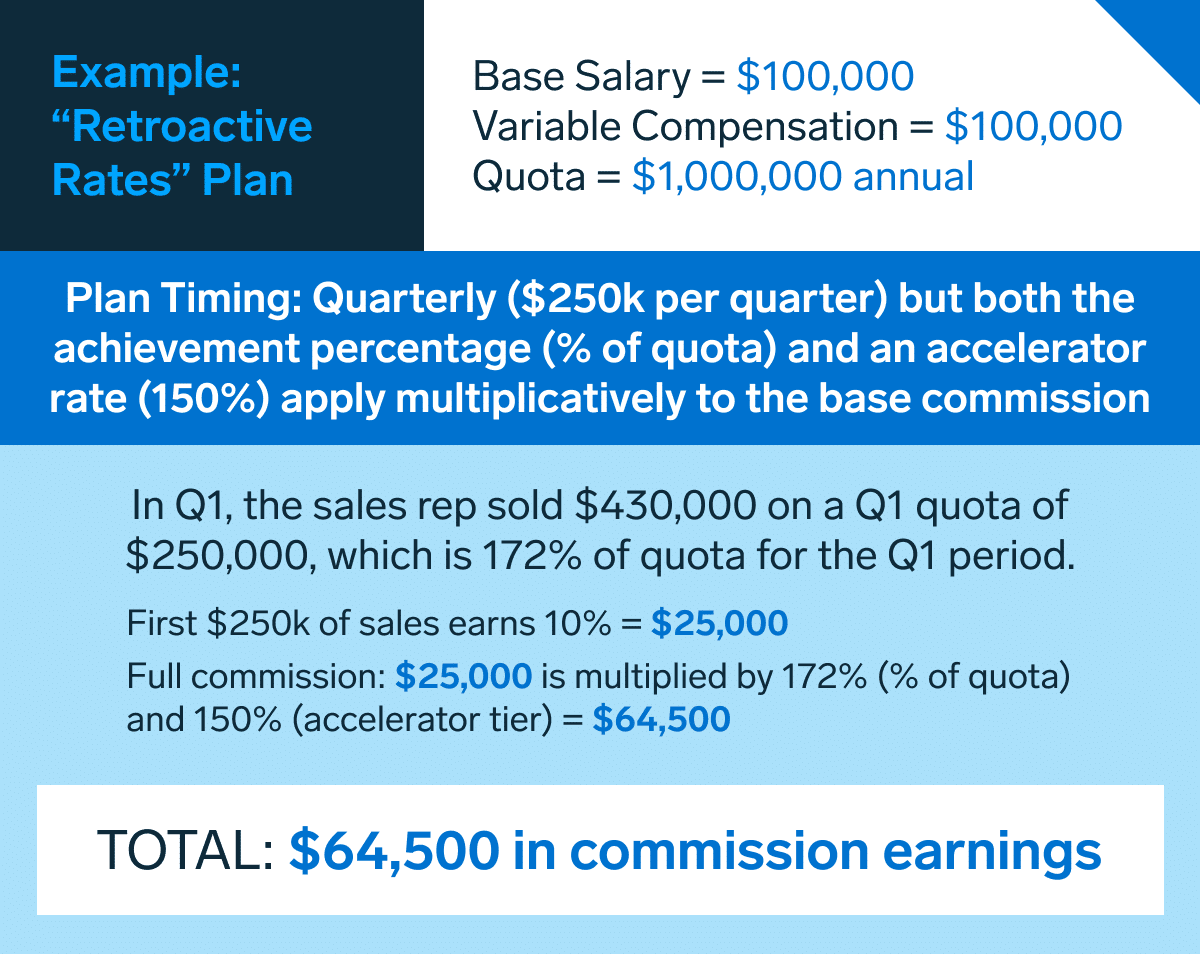

Exemple 3 : Atteindre la prochaine falaise (régime des taux rétroactifs)

Il s'agit du plan le plus motivant de tous les exemples. Ce plan permet au représentant de passer à un niveau supérieur une fois qu'il a franchi un palier et d'être payé pour tous les dollars à ce taux plus élevé. Les représentants commerciaux adorent ce plan car ils gagnent ce taux plus élevé sur tous les dollars vendus au cours de cette période.

Dans ce cas, le représentant gagne 64 500 $. Ils ont vendu 430K$, ce qui représente 172% du quota pour la période Q1, ils sont donc au niveau supérieur de l'accélérateur = 150%. Pour calculer leur commission, prenez la commission de 25 000 $ à 100 % du plan, multipliez-la par 172 % (leur pourcentage de performance) et multipliez-la par 150 %. Dans ce cas, le représentant a vendu 172 % de son quota et a réalisé 258 % de sa variable cible pour le trimestre. Vous comprenez maintenant pourquoi les gens se lancent dans la vente !

En conclusion...

Pour rappel, il ne s'agit là que de l'essentiel. Ce blog ne traite pas de la fréquence des paiements de commissions, par exemple, mais il s'agit d'un autre outil concurrentiel. Les plans de rémunération peuvent rapidement devenir plus complexes en incorporant des éléments qui rémunèrent différemment les accords pluriannuels, qui rémunèrent différemment la manière dont les liquidités sont perçues (trimestriellement ou annuellement), qui rémunèrent des incitations à la cohérence, qui rémunèrent des taux pour les mises en œuvre, etc.

Les bons représentants commerciaux prennent connaissance du plan de rémunération et le décortiquent rapidement, afin de déterminer les meilleurs moyens de maximiser leurs revenus. En tant que PDG ou CRO, relevez vous-même le défi - sortez votre ordinateur et calculez le salaire d'un AE. Est-il motivant et attirera-t-il les talents, ou devez-vous donner un coup de jeune à vos projets ?

Les informations contenues dans le présent document sont basées uniquement sur l'opinion de Bill Binch et rien ne doit être interprété comme un conseil en matière d'investissements. Ce matériel est fourni à titre d'information et ne constitue en aucun cas un conseil juridique, fiscal ou en matière d'investissement, ni une offre de vente ou une sollicitation d'une offre d'achat d'une participation dans un fonds ou un véhicule d'investissement géré par Battery Ventures ou toute autre entité Battery. Les opinions exprimées ici sont uniquement celles de l'auteur.

Les informations ci-dessus peuvent contenir des projections ou d'autres déclarations prospectives concernant des événements ou des attentes futurs. Les prévisions, opinions et autres informations présentées dans cette publication sont susceptibles d'être modifiées en permanence et sans préavis d'aucune sorte, et peuvent ne plus être valables après la date indiquée. Battery Ventures n'assume aucune obligation et ne s'engage pas à mettre à jour les déclarations prévisionnelles.

Un bulletin d'information mensuel pour partager de nouvelles idées, des aperçus et des introductions pour aider les entrepreneurs à développer leurs entreprises.